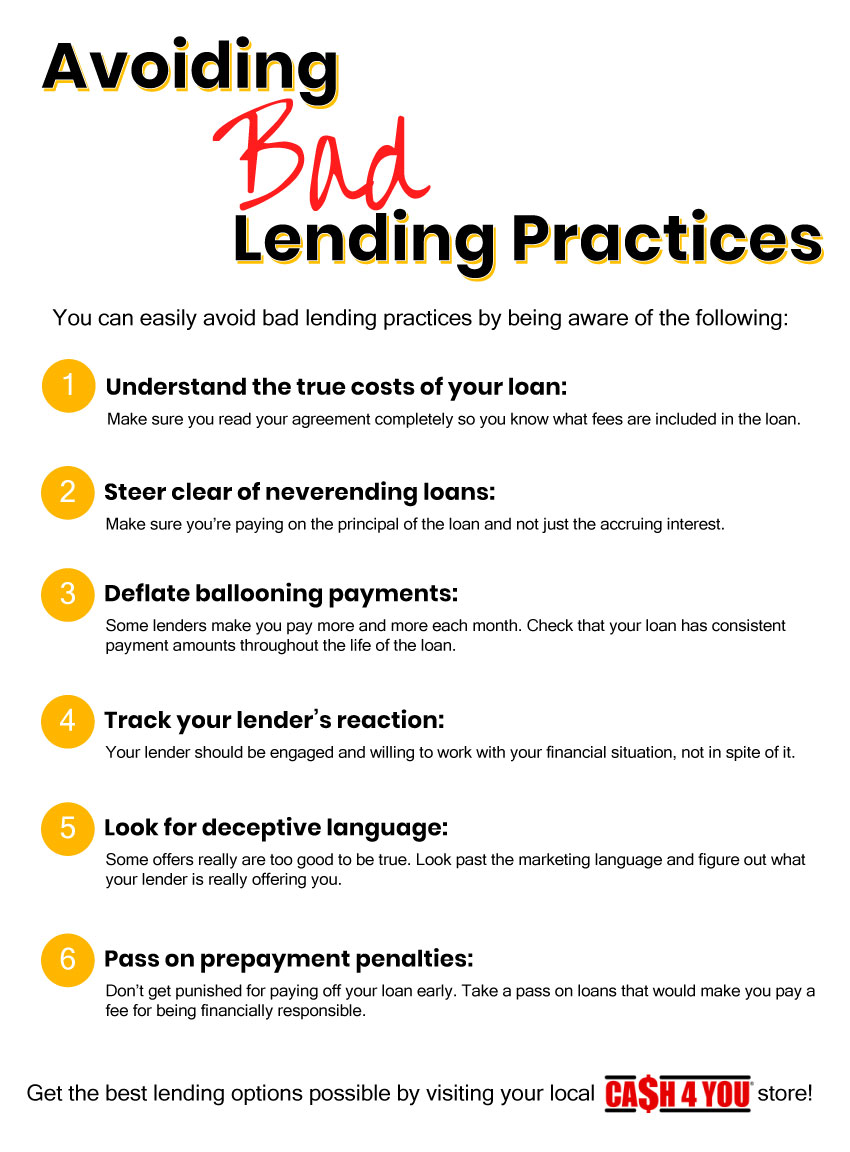

Let’s face it. Managing money can be difficult sometimes. When you find yourself short a few dollars, it’s natural to turn toward a payday or installment loan. But if you’re not near your local Cash 4 You store in Ontario, you might have to turn to a lender you haven’t worked with before. In these moments, it’s important that you make smart borrowing decisions so you avoid bad lending practices. To ensure you’re always getting the best lending terms, Cash 4 You has put together this quick-hitting guide.

Make Sure You Know the True Cost of a Loan

When you apply for a loan, it’s always a good idea to take your time and review all of the accompanying paperwork. We understand that no one except lower level bureaucrats enjoys doing paperwork, but it’s especially important for you to do so when taking on a loan. That’s because within the loan terms are the true costs of the loan itself.

Good lenders will happily provide you with everything you need to know about the loan, as well as any risks that you should be aware of before you agree to it. Whenever you apply for a loan, the lender should offer you a loan estimate. This estimate is packed with every detail about the loan and its terms, including your repayment options and timeline, the estimated interest rates, and any other costs. The estimate will also note if there are penalty fees for late payment and if the interest rates can change during the length of the loan.

At Cash 4 You, transparency is standard practice. You’ll never be subjected to any kind of hidden fee, and we won’t add on any expensive products.

Stay Away From Loans That Can’t Be Paid Off

This might sound like an impossibility, but sometimes unscrupulous lenders will structure a loan in a way that makes it quite a challenge to pay off. In some cases, they’ll set up the loan and only charge you interest payments, which keep you from ever paying off the principal of the loan itself. In cases like these, you might get stuck making payments on a loan that never seems to shrink in size.

In order to avoid getting caught in an endless cycle of loan payments and never making any progress, make sure to take a look at the amortization schedule and ensure that you can actually pay off the loan before you agree to it in the first place. Similarly, if the lender is hesitant to discuss the amortization schedule, or refuses to provide you with one entirely, it’s in your best interest to walk away from the loan agreement.

Be Aware of Inflating Payments

It’s not uncommon for some shady lenders to include stipulations in the agreement that allow them to set “ballooning” payments or payment amounts that slowly grow over time. Some borrowers have been treated to a low monthly payment up front, but have found themselves paying more and more month after month until they’re forced to make one extra large payment at the end of the loan. Lenders set up the loan this way in order to get you to refinance the loan so you can meet the large payments, and so they can make more money off of you.

Like our last tip, make sure to ask to see the amortization schedule. It should outline how much you’re paying each month so you have a clear idea. If the lender will only tell you your initial payment amounts, it’s best to let that lending option float on by without a second glance.

Pay Attention to How a Lender Reacts to Your Finances

First off, no decent lender will ever comment on or try and shame you about your financial situation. We’ve all been in tight spots before. But do measure the lender’s reaction to your finances when you first start talking about lending options. Predatory lenders will be unconcerned about your standing. They’ll find other ways to lend you money and will structure the loans in a way that forces you to pay more fees.

Keep an Eye Out for Deceptive Language

We’ve all heard the brace of doublespeak and legalese that’s at the end of every lender’s advertisements on TV and radio. But hidden within these speedy sentences is a bundle of deceptive language that can trick you into a bad lending situation. For instance, take the phrase “no upfront fees.” This is commonly used by lenders to draw you in, thinking you’re getting a great deal. However, look carefully at the phrase, and you’ll see that only the fees upfront are avoided, anything after that is subjected to fees.

Don’t get wrapped up in the advertising, and instead make sure to get the loan in writing and review it before you agree to it.

Steer Clear of Prepayment Penalties

The fact of the matter is, if you can pay off your loan early, you shouldn’t be punished for it. However, some lenders will do just that. A prepayment penalty means that the lender will assess you a fee if you pay off your loan early. This penalty may be a fixed amount, or it will be a percentage of the remaining loan balance. No matter how they determine this penalty amount, you’re being unfairly treated for your sound financial tactics.

Cash 4 You wants to reward our customers for being financially sound and educated, so you’ll never have to worry about paying an early payment fee when you take out a short-term loan with us.

Ontario’s Most Trusted Money Lender

Of course, you can avoid all of these dastardly lending tactics simply by visiting the Cash 4 You store closest to you! With more than 100 locations all over Ontario, it’s easy to get the cash you need when you need it. We offer payday loans of up to $1,500 and installment loans for up to $15,000 so you can get the right amount of money for your needs. Start your application online, or see us in person today!