At Cash 4 You, we understand that there is a lot more to your financial profile than just your credit score. But the truth of the matter is, a poor credit score can keep you from achieving your financial goals and living the life you want to live. On the other hand, building a positive credit profile can give you a solid financial foundation while enhancing your purchasing power.

As the Top Rated National® money solutions retailer in Ontario, our goal is to help you get the money you need while building your credit through the personal loans we offer. Let’s explore the myCreditBoost™ benefit, how it works, and how it can help transform your credit profile for the better.

What is myCreditBoost™?

If you are ready to make a positive impact on your credit history, myCreditBoost™ can help. This credit-building benefit is an extension of your personal loan with Cash 4 You. It is designed to be a simple and straightforward benefit that helps you build your credit score over time by making your loan payments on-time by cash or debit.

How It Works

myCreditBoost™ is one of the simplest ways to improve your credit score. Here’s how it works.

Apply for a Personal Loan

Visit Cash 4 You to apply for your loan online, or drop by one of our more than 100 locations in Ontario to apply in person. Getting approved for installment loans in amounts of up to $15,000 takes only minutes. Once approved, simply agree to the terms of your loan and get your money the same day you’re approved.

Make Regularly Scheduled Payments On-Time

Once you are approved for your loan, you can start building your credit by making your regularly scheduled payments on-time according to the agreed-upon repayment terms. Your loan payments will be due according to your pay frequency, ranging from weekly, bi-weekly, semi-monthly, and monthly payments.

Build Positive Credit Marks on Your Credit History

Here at Cash 4 You, we value your on-time payments and we understand just how important they are to your credit profile. That’s why, unlike other money lenders, we report your timely loan payments to all of the major credit bureaus, including TransUnion and Equifax. As you make your scheduled payments, we report them, and you accumulate positive impressions on your credit history with each on-time payment. That’s right! It really is that easy!

Keep in mind that missing payments or making late payments can significantly impact your credit history by dropping your score. That’s why if you miss a payment or make a late payment, you will want to contact Cash 4 You right away to explore your options. Our friendly lenders are here to help you.

Is a Credit-Building Loan Right for Me?

Whether you already have good credit and you want to make it better or you have poor or no credit and want to build your credit history, myCreditBoost™ is a simple yet effective solution for you. By taking out a personal loan with Cash 4 You, you get the money you need to spend how you need, and you can improve your credit at the same time, simply by paying your loan installments on-time.

Building your credit is the best way to improve your purchasing power while establishing a solid financial foundation for you and your family. That’s why our credit-building loans are ideal for anyone who wants to strengthen their credit profile.

Get Instantly Approved for an Installment Loan Now!

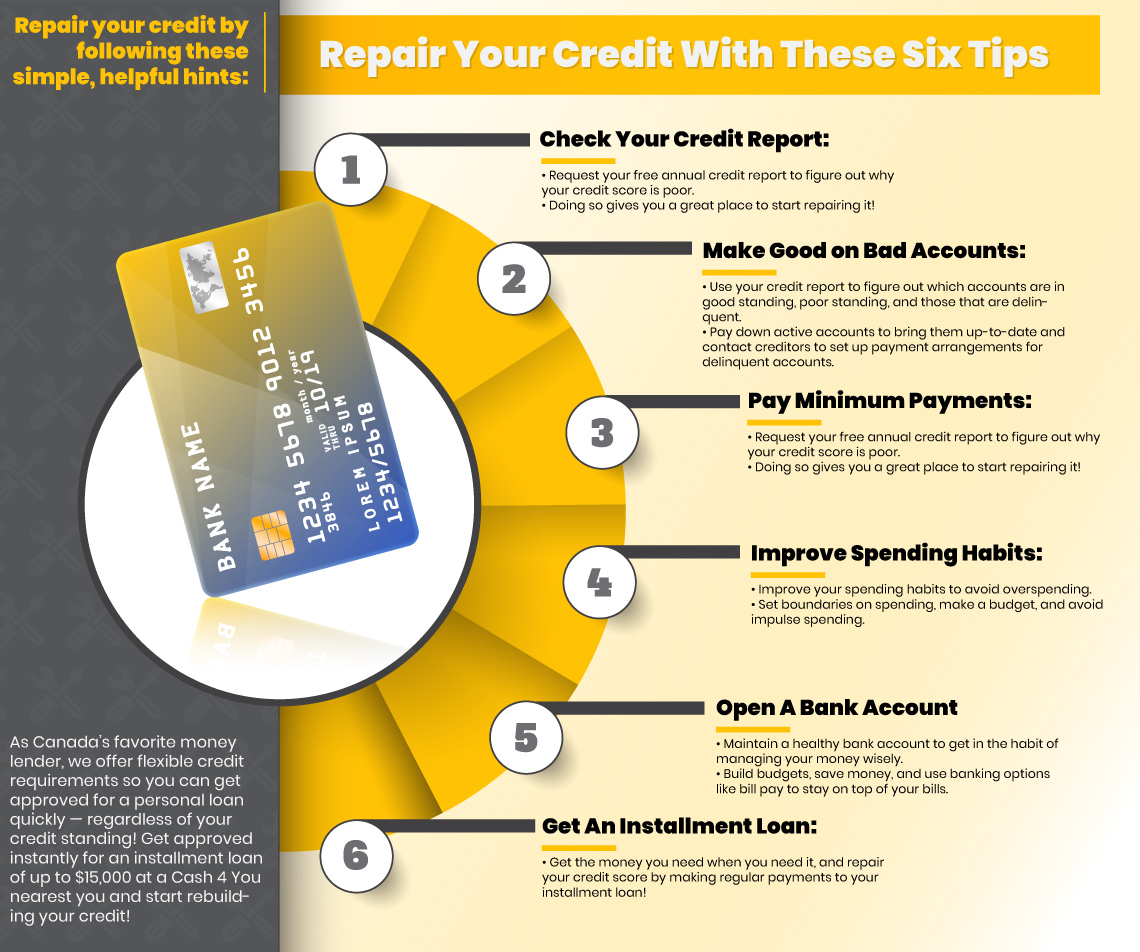

There’s never been a better time than now to start building your credit, and we can help. Visit Cash 4 You to apply for a loan online, or stop by one of our 100-plus stores located in Ontario to get instantly approved. Whether you need $1,000 or $15,000, we have a sensible personal loan for you. Better yet, our relaxed credit requirements make getting instantly approved for your loan simple, fast, and hassle-free. Get approved now, start making timely loan payments, and enjoy the benefits of myCreditBoost™. It’s time to take control of your financial future!

Want to stay up-to-date on all of our money solutions, watch handy credit-building tips, and so much more? Subscribe to the Cash 4 You YouTube channel where you can watch insightful and entertaining videos about all things loans, money-saving tips, and more. Subscribe today!